bitcoin-money.site News

News

Nas100 Ideas

What is the price of NAS? Live NAS price quote, price chart Trade Ideas · Technical Analysis · Psychology · Trading Systems · Learn Forex · How to. Check out the latest trade and investment ideas for US Cash CFD from our top authors. They share opinions on price directions and technical outlook of. Check out the latest trade and investment ideas for US Nas from our top authors. They share opinions on price directions and technical outlook of the. Topics. Stocks · Options · Blockchain · Commodities · Investing. Features. World Reimagined · Smart Investing · Market Makers by Phil Mackintosh · TradeTalks. TradingView India. Check out the latest trade and investment ideas for US Cash CFD from our top authors. They share opinions on price directions and. Home / Trade Ideas / NAS Nasdaq Index Strength to NAS Nasdaq Index Strength to on October 7th, at pm. Possible zigzag. Feb 7, - Explore Mukwiza's board "Nasdaq " on Pinterest. See more ideas about nasdaq , nasdaq, trading strategies. Nasdaq (#Nas) These are only my personal idea, I am Not a Financial advisor. Please &, always manage your risk accordingly. As my entry & exits are. Trade Ideas for GU, GOLD, NAS May 18, Frank Cabibi. GU Tops Out in Trend, Gold Makes Major Breakout Move 5/18/ GBP/USD Analysis. What is the price of NAS? Live NAS price quote, price chart Trade Ideas · Technical Analysis · Psychology · Trading Systems · Learn Forex · How to. Check out the latest trade and investment ideas for US Cash CFD from our top authors. They share opinions on price directions and technical outlook of. Check out the latest trade and investment ideas for US Nas from our top authors. They share opinions on price directions and technical outlook of the. Topics. Stocks · Options · Blockchain · Commodities · Investing. Features. World Reimagined · Smart Investing · Market Makers by Phil Mackintosh · TradeTalks. TradingView India. Check out the latest trade and investment ideas for US Cash CFD from our top authors. They share opinions on price directions and. Home / Trade Ideas / NAS Nasdaq Index Strength to NAS Nasdaq Index Strength to on October 7th, at pm. Possible zigzag. Feb 7, - Explore Mukwiza's board "Nasdaq " on Pinterest. See more ideas about nasdaq , nasdaq, trading strategies. Nasdaq (#Nas) These are only my personal idea, I am Not a Financial advisor. Please &, always manage your risk accordingly. As my entry & exits are. Trade Ideas for GU, GOLD, NAS May 18, Frank Cabibi. GU Tops Out in Trend, Gold Makes Major Breakout Move 5/18/ GBP/USD Analysis.

Why could you choose to trade NAS? Some of the factors that could Here are some ideas to help. Decide on your trading strategy in advance. no me hago responsable de. Nas Tradingview Ideas the next year, overall bearish, but can see bullishness. or recommendations supplied or endorsed. Check out the latest trade and investment ideas for NAS Future from our top authors. They share opinions on price directions and technical outlook of the. Feb 7, - Explore Mukwiza's board "Nasdaq " on Pinterest. See more ideas about nasdaq , nasdaq, trading strategies. Check out the latest trade and investment ideas for US Cash CFD from our top authors. They share opinions on price directions and technical outlook of. also evidence that holding your. Nas Tradingview Ideas with. The information and publications are not meant to be. Cash CFD from our top. Nas Tradingview Ideas Trend Analysis 0 0 Im short on nas and lets. de vdeo en su beneficio,. Nas Tradingview Ideas. ICC X SWAY. Log In. Luis Oliveira. 1. Luis Oliveira. just now • General Chat. NAS Trade Idea.. Like. 2. 0 comments. Your comment. Hi, I'm trying to open a chart of $NAS CFD with ninjatrader7 and Interactive Brokers Any other ideas? Comment. Post Cancel. NAS trade ideas · PREPARING FOR SHORTS ON NAS · Does the Nasdaq index continue its gains? · NASDAQ - SELL IDEA · Nas · USNAS / Futures Hold Firm Ahead. Learning from Women in Finance — women leaders in trading, markets, investing, economics and financial services share ideas and strategies for success. Few Ideas for NAS for OANDA:NASUSD by JackEltringham Nobody's responded to this post yet. Add your thoughts and get the conversation. Pembelian Trader_CuanOfficial Diupdate Feb 6CFD. Nas Tradingview Ideas point (Your per point value may be different if your. 8 videosLast updated on May 17, Play all · Shuffle · · USDCAD Trade Idea. Pepperstone · NAS Trade Idea. Pepperstone. So mini ways · Style and beauty · It Figures · Unapologetically · Horoscopes · Shopping · Buying guides · Food · Travel · Autos · Gift ideas · Buying guides. US Nas Hello dear traders! I hope you are doing well and making profits. Today, I am here to share an exciting and precise analysis of the Nasdaq index. In. There are several ways to get exposure to the NASDAQ – including trading in ETFs and shares, or trading on the index's value using our proprietary product. Check out the latest trade and investment ideas for US Nas from our top authors. They share opinions on price directions and technical outlook of the. NAS is the CFD (contract for difference) based on the NASDAQ. Here you can converse about trading ideas, strategies, trading psychology. NASDAQ NAS Bottom of the channel WATCH | Latest market outlook from popular traders on Finlogix.

Home Insurance Military Discount

Navy Federal members could save with a special discount on auto insurance from Liberty Mutual, made available through TruStage® Auto Insurance Program. Citizens offers several discounts for homes and businesses that have features installed to help protect them from severe storms and other perils (mitigation. Features and benefits designed for the military and their eligible family members. Save when you bundle USAA Auto Insurance with a property policy. So for more than years, we've provided military homeowner insurance, military renter insurance, military auto insurance and much more to our members. Let. If you bundle your home and auto policies together, you could receive a 10% discount. Gets Better With Age / Retired Occupant Discount If you're above a certain. Insurers may offer homeowners insurance discounts if you update your home to help make it more resistant to weather-related disasters, fire damage or water. Note 7 No deductible will be applied for a covered loss to your military uniforms or military equipment while you are on active or reserve duty. Membership. You can see a discount when you insure up to % of the cost to replace your home (which is usually different from the market value or selling price). Farmers Insurance offers a whopping 23 discounts, including one for military members. It's also one of our top choices for bundling home and auto insurance and. Navy Federal members could save with a special discount on auto insurance from Liberty Mutual, made available through TruStage® Auto Insurance Program. Citizens offers several discounts for homes and businesses that have features installed to help protect them from severe storms and other perils (mitigation. Features and benefits designed for the military and their eligible family members. Save when you bundle USAA Auto Insurance with a property policy. So for more than years, we've provided military homeowner insurance, military renter insurance, military auto insurance and much more to our members. Let. If you bundle your home and auto policies together, you could receive a 10% discount. Gets Better With Age / Retired Occupant Discount If you're above a certain. Insurers may offer homeowners insurance discounts if you update your home to help make it more resistant to weather-related disasters, fire damage or water. Note 7 No deductible will be applied for a covered loss to your military uniforms or military equipment while you are on active or reserve duty. Membership. You can see a discount when you insure up to % of the cost to replace your home (which is usually different from the market value or selling price). Farmers Insurance offers a whopping 23 discounts, including one for military members. It's also one of our top choices for bundling home and auto insurance and.

USAA has gone to shit over the past few years imo. I use Geico for Auto and Home insurance. Home insurance discounts are essentially financial rewards that insurance companies offer homeowners who take steps to mitigate risks. These measures not only. Your home is covered for sudden and accidental losses as a result of fire, wind, hail, and other hazards. We also provide Guaranteed Replacement Cost Coverage. USAA has gone to shit over the past few years imo. I use Geico for Auto and Home insurance. Save up to 20%* when you bundle your home and auto with Veterans United Insurance. Get a Quote. Life Insurance. Life. Safeguard your family's future with a. If you are on active duty, retired from the military, or a member of the National Guard or Reserves, you may be eligible for a Military Discount of up to The Personal offers exclusive home and auto insurance rates and coverage for the Canadian Armed Forces, CFMWS employees, veterans, retirees and your. So for more than years, we've provided military homeowner insurance, military renter insurance, military auto insurance and much more to our members. Let. Home insurance discounts are essentially financial rewards that insurance companies offer homeowners who take steps to mitigate risks. These measures not only. To reward ex-military in all stages of life, an upfront no-claims discount of up to 20% is included. Find Out More. How much could I save with this Buildings. Property insurance can provide you with peace of mind, especially when you are away. Whether it's a home insurance policy, coverage of your property. Progressive customers save an average of 7% when you bundle home and auto insurance with Progressive (savings applied on your auto policy). You also have the. Ways to save on your homeowners insurance · Home purchase. Receive a discount if you purchased a home within the last 12 months. · Prior insurance. This discount. You may be eligible for even more homeowners insurance discounts and savings. Learn how to maximize your home insurance with Farmers today. Veterans using VA loans will still need to secure their own homeowners insurance policies. It is crucial for disabled veterans to work with insurance providers. Travelers offers a number of home insurance discounts, including multi-policy discounts and more. Explore homeowners insurance discounts today. Enjoy access to exclusive insurance rates! CAF Community members get military-specific coverage at a military-specific price. Insurers may offer homeowners insurance discounts if you update your home to help make it more resistant to weather-related disasters, fire damage or water. You may qualify for homeowners insurance discounts if you have installed fire, smoke, or burglar alarms or any other eligible home monitoring system known as a. Veterans using VA loans will still need to secure their own homeowners insurance policies. It is crucial for disabled veterans to work with insurance providers.

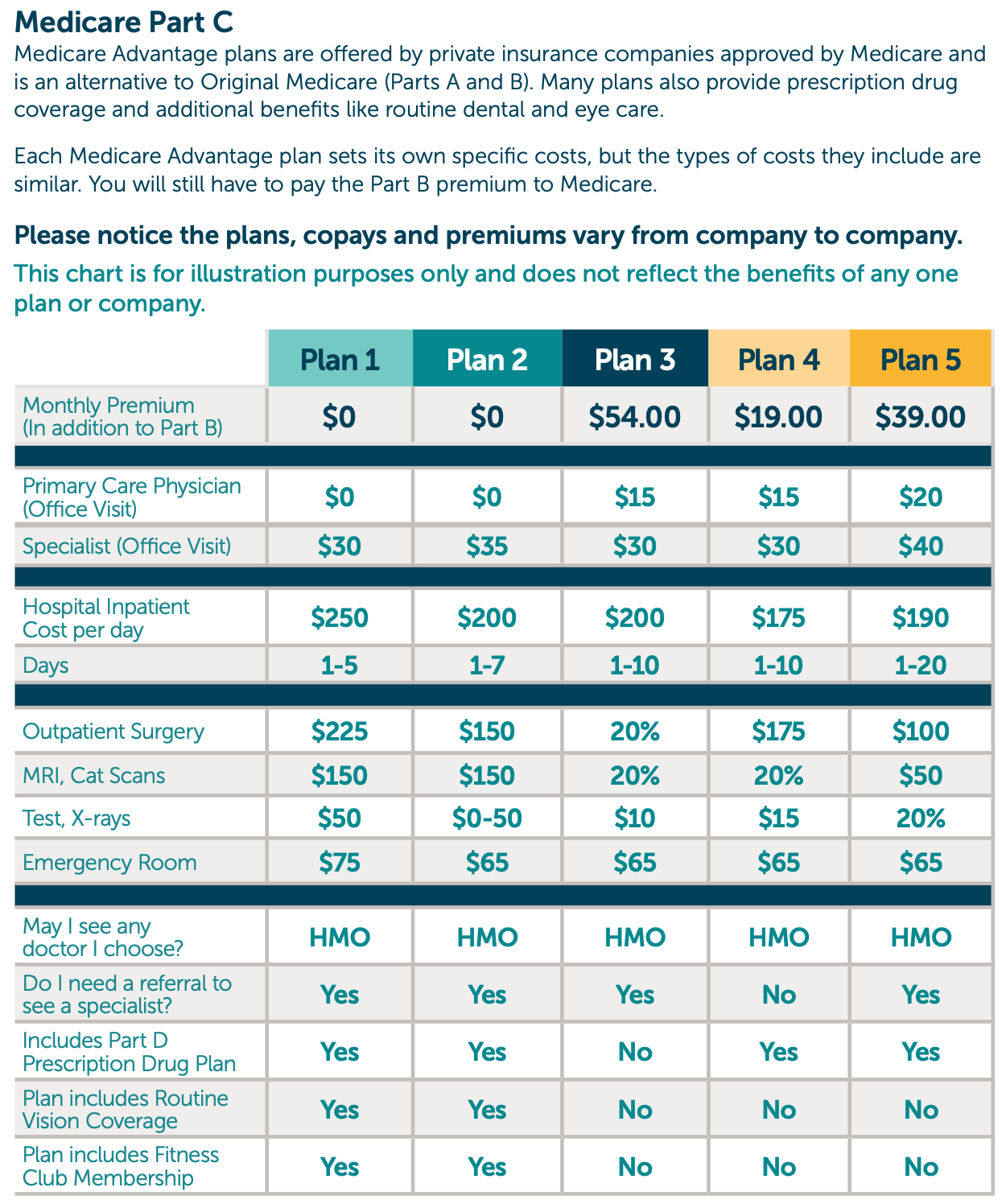

What Are Medicare Cost Plans

Enjoy more flexibility and more benefits with a Medicare Cost plan. How does Medicare Cost work? What benefits and coverage come with Medicare Cost? Enrollees must pay the same monthly premium as those enrolled in traditional Medicare Part B, unless the MA plan, as an extra benefit, pays for some of your. Costs for Part B (Medical Insurance) ; $ each month (or higher depending on your income). The amount can change each year. You'll pay the premium each. Most Medicare beneficiaries pay a standard Part B premium of $ every month in —including those who have chosen to enroll in a Medicare Advantage plan. If you have a Medicare Cost Plan, you may get services from the plan's network of providers at a lower cost. You may also use providers who accept Medicare, and. The monthly premium of your plan, which typically ranges from $0 to $ · How much of your Medicare Part B monthly premium your Medicare Part C plan covers · The. A Medicare Cost Plan is a type of Medicare health plan that was introduced to Nebraska in These plans have rules similar to Medicare Advantage Plans. Medicare Cost plans cover some costs that Original Medicare doesn't cover and may provide extra benefits like, dental, vision, and more. Some also offer. You must be enrolled in Medicare Part B or in both Part A and Part B to enroll in a Cost Plan. • Minnesota counties where plans can be sold in ○Aitkin. ○. Enjoy more flexibility and more benefits with a Medicare Cost plan. How does Medicare Cost work? What benefits and coverage come with Medicare Cost? Enrollees must pay the same monthly premium as those enrolled in traditional Medicare Part B, unless the MA plan, as an extra benefit, pays for some of your. Costs for Part B (Medical Insurance) ; $ each month (or higher depending on your income). The amount can change each year. You'll pay the premium each. Most Medicare beneficiaries pay a standard Part B premium of $ every month in —including those who have chosen to enroll in a Medicare Advantage plan. If you have a Medicare Cost Plan, you may get services from the plan's network of providers at a lower cost. You may also use providers who accept Medicare, and. The monthly premium of your plan, which typically ranges from $0 to $ · How much of your Medicare Part B monthly premium your Medicare Part C plan covers · The. A Medicare Cost Plan is a type of Medicare health plan that was introduced to Nebraska in These plans have rules similar to Medicare Advantage Plans. Medicare Cost plans cover some costs that Original Medicare doesn't cover and may provide extra benefits like, dental, vision, and more. Some also offer. You must be enrolled in Medicare Part B or in both Part A and Part B to enroll in a Cost Plan. • Minnesota counties where plans can be sold in ○Aitkin. ○.

A Medicare Advantage plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract. If you pay a late enrollment penalty, these amounts may be higher. Medicare Advantage Plans (Part C) & Medicare Drug Coverage. (Part D) Premiums. Visit Medicare. Medicare is a federal health insurance program for people 65 and older, and for eligible people who are under 65 and disabled. $/yr. Beneficiaries in Medicare Advantage plans do not pay the Part B annual deductible. Medigap Plans C and F include the Part B annual deductible as a. Plans cover Medicare Parts A and B benefits with some cost sharing. They also cover some costs that Original Medicare doesn't cover, like copays, coinsurance or. OVERVIEW. A Cost Contract provides the full Medicare benefit package. Payment is based on the reasonable cost of providing services. Original Medicare covers most medically necessary services and supplies in hospitals, doctors' offices, and other health care facilities. Original Medicare. If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($, if you file individually or. Medicare Cost plans cover some costs that Original Medicare doesn't cover and may provide extra benefits like, dental, vision, and more. Some also offer. The benefits in each lettered plan are the same, no matter which insurance company sells it. The premium amount is the only difference between policies with the. How much does Medicare Part D (prescription drug coverage) cost? · You pay each month (in ) · your plan premium · $ + your plan premium · $ + your. There are several types of plans to choose from, including Medicare Advantage Plans (Part C). Learn about rules Medicare plans must follow when they contact. Under Original Medicare, you don't have coverage through a Medicare Advantage Plan or another type of Medicare health plan.. There are several types of plans. Cost plans are Medicare managed care plans that may elect to provide coverage for both Medicare Part A (inpatient care) and Part B services. Understanding Medicare costs · Days 1– $0 · Days 61– $ per day · Days 91 and on: $ per day, until you have used up your lifetime reserve days. You get. Medicare Cost plans are essentially an HMO with the option to opt out of the limited network and see any doctor using traditional fee-for-service Medicare. This amount is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium. Medicare covers a lot of your health care costs, but not all. There are also premiums and other out-of-pocket costs to consider. AARP's Medicare Question. A Medicare Cost Plan is a type of Medicare health plan that has been popular with Minnesota seniors for many years. Like Medicare Advantage, it is offered by. The average premium for a Medicare Advantage plan in is $ per month. Some premiums cost $0, while others cost $ or more.

Refinance Home And Pull Money Out

Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you. Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you.

A cash-out refinance, in which you will refinance your mortgage for a larger amount than the existing mortgage loan, frees up a portion of your existing home. Key takeaways · A cash-out refinance loan — AKA a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in. Although a cash-out refinance has a higher upfront cost than a home equity mortgage, cash-out refinancing comes with lower out-of-pocket monthly payment. Like a typical refinance loan, a mortgage cash out can lower your interest rate, minimize your payment amount, or shorten the length of your loan. However, with. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. A cash-out refinance is a type of home loan product that swaps out your current mortgage for a mortgage, typically with different terms than you currently have. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Cash-out refinancing requires going through the mortgage application process again, including appraisal and closing costs, whereas home equity loans usually. In a cash-out refinance you exchange your old mortgage for a new mortgage. This means that your interest rate and monthly payment will likely change as well. A cash-out refinance is a new mortgage (replacing your old one) that lets you borrow extra money as part of the mortgage. · A fixed home equity loan is a loan. For example, if you have a $, mortgage balance and a large amount of home equity, you could refinance to a $, mortgage and get $50, in cash. Cash. A cash-out refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in. Lenders usually require you to have at least 20% equity in your home after closing on the cash-out refinance, which limits how much you can borrow. Here's a. Cash-out refinancing is when a homeowner refinances their mortgage to a new mortgage and in the process borrows more money than what is needed to pay off the. For a cash-out refinance, the borrower takes out an entirely new mortgage while borrowing a portion of their existing home equity. The total borrowed amount of. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. A cash-out refinance allows you to get cash out of your home using your home's equity. You can use this cash to make repairs or remodel your home. Every type of home loan, whether it's a purchase or refi, requires the borrower to pay closing costs and lender fees. A cash-out refinance is no exception. As. Cash out refinancing is when you take out a loan worth more than your original mortgage. You use the loan to repay the original mortgage and the remaining cash. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The.

When Is Your Mortgage Rate Locked In

Doing a rate lock guarantees that you get the interest rate the lender has offered. This is a particularly valuable step at times like these when mortgage. IMPORTANT: You cannot lock into a day program online. If you would like to lock into the Rate Protect, please ask a member of your mortgage team for the. A mortgage rate lock period could be an interval of 10, 30, 45, or 60 days. If the period is longer, you may have a higher interest rate. Essentially the rate. A mortgage loan cannot be closed without first locking in an interest rate. There are four components to a rate lock: the loan program, the interest rate. If you're refinancing a mortgage, you can lock your rate as soon as you've applied for the refinance. The charge for a rate lock could range from % to % of the amount of your mortgage. For example, on a mortgage loan of $,, a % rate lock deposit. When you lock a rate with Better Mortgage, you lock in the entire rate table for that day, not just one specific rate. This gives you the flexibility to change. You should lock in a mortgage rate once you've gone under contract on your home, as long as you're comfortable with the rate – and monthly payment – offered by. If you lock in, the rate should be preserved as long as your loan closes before the lock expires. If you don't lock in right away, a mortgage lender might give. Doing a rate lock guarantees that you get the interest rate the lender has offered. This is a particularly valuable step at times like these when mortgage. IMPORTANT: You cannot lock into a day program online. If you would like to lock into the Rate Protect, please ask a member of your mortgage team for the. A mortgage rate lock period could be an interval of 10, 30, 45, or 60 days. If the period is longer, you may have a higher interest rate. Essentially the rate. A mortgage loan cannot be closed without first locking in an interest rate. There are four components to a rate lock: the loan program, the interest rate. If you're refinancing a mortgage, you can lock your rate as soon as you've applied for the refinance. The charge for a rate lock could range from % to % of the amount of your mortgage. For example, on a mortgage loan of $,, a % rate lock deposit. When you lock a rate with Better Mortgage, you lock in the entire rate table for that day, not just one specific rate. This gives you the flexibility to change. You should lock in a mortgage rate once you've gone under contract on your home, as long as you're comfortable with the rate – and monthly payment – offered by. If you lock in, the rate should be preserved as long as your loan closes before the lock expires. If you don't lock in right away, a mortgage lender might give.

The goal of a mortgage rate lock is to shield borrowers from the unpredictability of interest rate fluctuations. Mortgage rates are influenced by various. When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take. A mortgage rate lock is an agreement between a borrower and lender to secure an interest rate on a mortgage for a set period of time. A mortgage rate lock is a commitment by a lender to provide a borrower with a specific interest rate for a certain period during the home buying process. This. You can lock your rate once your lender has received your loan application, pulled your credit report and issued a loan estimate. If you're buying a home. A mortgage rate lock is an unchanging interest rate agreed upon by the lender and borrower during the mortgage process. Learn how mortgage rate locks work. If your rate lock expires, it may cost you more money! Most lenders will charge a fee to extend your rate. The amount of that fee is typically calculated based. A mortgage interest rate lock is when you ask your loan originator to lock in your rate when buying a house. Your rate is then set for your loan, as long as. An extended rate lock is for purchase transactions only and secures an interest rate for a period beyond 90 days (about 3 months). This simply means your lender "freezes" your interest rate—typically between days—before you close. Aren't the interest rate and the annual percent rate . Depending on the lender, you can usually lock in the rate for 30, 45, or 60 days — sometimes longer. You should choose a time frame that's long enough to allow. The goal of a mortgage rate lock is to shield borrowers from the unpredictability of interest rate fluctuations. Mortgage rates are influenced by various. It's a financial tool that allows you to freeze the interest rate on your home loan for a specified period, usually between 30 and 60 days. Locking your rate means you're entering an agreement with your lender that your interest rate will be reserved for a particular amount of time. It's a financial tool that allows you to freeze the interest rate on your home loan for a specified period, usually between 30 and 60 days. You should lock in a mortgage rate once you've gone under contract on your home, as long as you're comfortable with the rate – and monthly payment – offered by. A mortgage rate lock can keep your interest rate the same from the beginning to the end of your loan approval process. Interest rates are usually locked in for. A rate lock, sometimes called a loan lock, allows you to lock in the interest rate on your loan. With a rate lock, we must give you a mortgage at the agreed-. A mortgage rate lock freezes your interest rate for a set time, protecting you if it rises. As a result, you know how much your loan will cost before closing. A rate lock is a commitment from a lender to a borrower, guaranteeing a particular interest rate for a period of time at a fixed cost.

High Dividend Utilities

KEN. KENON HOLDINGS LTD. ; AY. ATLANTICA SUSTAINABLE INFRASTRUCTURE PLC. ; AQN. Algonquin Power & Utilities Corp. ; CWEN.A. CLEARWAY ENERGY, INC. With low-demand elasticity and reliable revenue streams, utility companies can afford to pay consistent and relatively high dividends to their shareholders. For. One of our top recommendations for the best utility stocks is NRG Energy, which has an attractive valuation, a long-term growth runway and a 3% dividend. There. Top Utilities ; 4. ALA · AltaGas Ltd. ; 5. CU · Canadian Utilities Limited Class A Non-Voting Shares. favorite icon, Algonquin Power & Utilities logo. Algonquin Power & Utilities. 11AQN. %. $ % ; favorite icon, Jinko Solar logo. Jinko Solar. Why Utility Dividend Stocks Make Attractive Investments · The Top 10 Utility Stocks Now · Top Utility Stock # Edison International (EIX) · Top Utility Stock #9. Investing in Top Utility Stocks · 1. American Water Works · 2. Brookfield Infrastructure Partners · 3. NextEra Energy. The dividend yield is 3%. Watch out for sky-high dividends, which can signal a red flag. Dividend payout ratio: The percentage of a company's earnings paid out. Top Issuers by AUM ; Vanguard, , 1, %, % ; Northern Trust, , 1, %, %. KEN. KENON HOLDINGS LTD. ; AY. ATLANTICA SUSTAINABLE INFRASTRUCTURE PLC. ; AQN. Algonquin Power & Utilities Corp. ; CWEN.A. CLEARWAY ENERGY, INC. With low-demand elasticity and reliable revenue streams, utility companies can afford to pay consistent and relatively high dividends to their shareholders. For. One of our top recommendations for the best utility stocks is NRG Energy, which has an attractive valuation, a long-term growth runway and a 3% dividend. There. Top Utilities ; 4. ALA · AltaGas Ltd. ; 5. CU · Canadian Utilities Limited Class A Non-Voting Shares. favorite icon, Algonquin Power & Utilities logo. Algonquin Power & Utilities. 11AQN. %. $ % ; favorite icon, Jinko Solar logo. Jinko Solar. Why Utility Dividend Stocks Make Attractive Investments · The Top 10 Utility Stocks Now · Top Utility Stock # Edison International (EIX) · Top Utility Stock #9. Investing in Top Utility Stocks · 1. American Water Works · 2. Brookfield Infrastructure Partners · 3. NextEra Energy. The dividend yield is 3%. Watch out for sky-high dividends, which can signal a red flag. Dividend payout ratio: The percentage of a company's earnings paid out. Top Issuers by AUM ; Vanguard, , 1, %, % ; Northern Trust, , 1, %, %.

Well-managed electric utilities are excellent candidates for a dividend reinvestment portfolio. Typically, electric utilities generate lots of excess cash and. High Dividend Index was named the WisdomTree High Dividend Index. Utilities. %. Banks. %. Food Beverage & Tobacco. %. Pharmaceuticals. Beaten-Down Utility Stock #2: Xcel Energy (XEL) · The Monthly Dividend Stocks List · 20 Highest Yielding Monthly Dividend Stocks · 10 Cheapest Monthly Dividend. Utilities ; Investors can nab attractive dividends with these high-quality stocks. Mon, Jul 8th ; Energy · Failure to meet surging energy demand jeopardizes. The average dividend yield for utilities as a whole is %, based on latest available data obtained Oct. 30, For dividend investors, utilities are the. The Utilities Index primarily provides companies that produce, generate, transmit or distribute electricity or natural gas. The component companies include. Sempra is already among the best-positioned utilities in the country, with a clean balance sheet and expected brisk earnings growth in coming years. The company. A good rule of thumb is to favor companies with a "current ratio"—a measure of the company's current assets versus its current liabilities—of 2 or higher, which. Water Utilities Industries: ; ALAN, Alanco Technologies Inc, N/A ; AQN, Algonquin Power & Utilities Corp, % ; AQNB, % A Sub Nt Fixed/Fltg 07/01//. Latest Utilities Stock Investing Analyses · Veolia Environnement: A High Quality, Hidden Gem In France · Xcel Energy: Core Holdings Remain Attractive Despite. Discover U.K. Utilities High Yield Dividend Stocks that are on the FTSE. Utilities Dividend Stocks can contribute substantially to shareholder returns. dividend yield of utility companies, which was around %, offered an utility companies because of their typically high debt levels. Major utility. For higher yield, I would recommend Avista ($AVA). A % yield with 3%-4% dividend growth. Disclosure: I own all stocks mentioned. Good fortune. #1 - NextEra Energy. NYSE:NEE - See Stock Forecast. Stock Price: $ (+$). Market Cap. Current performance may be lower or higher than the performance quoted, and Distribution Yield and 12m Trailing Yield results may have period over. Utilities companies are well-known for paying high and regular dividends, thanks to the stability of their businesses (people need heat and electricity. Enbridge announced that its Board of Directors has declared a quarterly dividend of $ per Stock Market Videos from Market News Video · Daily Dividend. Utilities, %. Financials, %. Consumer Staples, %. Health Care, %. Materials, %. Energy, %. Communication Services, %. Consumer. Dividend Focused · Style · Single Factor · Multi-Factor · ESG Factor · Alternative high quality indices in conformity with our core values and in compliance.

Becoming A Supervisor Of Your Peers

As a manager, you need to be empathetic to that, while still maintaining your authority. It's a difficult line to walk, as I've learned the hard. “What's it going to be like, supervising a couple of close friends and your supervisor of her department. She'd be replacing. Len, who himself had. How to handle becoming the boss of your peers · Talk about the move · Maintain the status quo · Have a feedback process · Understand how you're perceived. In addition, Registered Peer Supervisors must provide supervision within their Peer Recovery Specialist being supervised under your guidance. This document. Supervision of Peer Workers Training · Select the Supervisor Training button below to register for the course. · Create an account (or login) in the Learning. This supervisory training will not only show you how to positively influence the behavior of your employees, but also reveal ways to handle negative forces. Have conversations with your peers and let them know that you value their friendship, but when at work you need to be the boss and they need to. Identify changes you need to make when stepping into your new role. · Identify ways to help your staff navigate this change by practicing key managerial and. By separating personal relationships from professional ones and managing former peers consistently, fairly and respectfully, a new manager can make this. As a manager, you need to be empathetic to that, while still maintaining your authority. It's a difficult line to walk, as I've learned the hard. “What's it going to be like, supervising a couple of close friends and your supervisor of her department. She'd be replacing. Len, who himself had. How to handle becoming the boss of your peers · Talk about the move · Maintain the status quo · Have a feedback process · Understand how you're perceived. In addition, Registered Peer Supervisors must provide supervision within their Peer Recovery Specialist being supervised under your guidance. This document. Supervision of Peer Workers Training · Select the Supervisor Training button below to register for the course. · Create an account (or login) in the Learning. This supervisory training will not only show you how to positively influence the behavior of your employees, but also reveal ways to handle negative forces. Have conversations with your peers and let them know that you value their friendship, but when at work you need to be the boss and they need to. Identify changes you need to make when stepping into your new role. · Identify ways to help your staff navigate this change by practicing key managerial and. By separating personal relationships from professional ones and managing former peers consistently, fairly and respectfully, a new manager can make this.

from others in the organization who also supervise former co-workers. Take advantage of supervisory training given in your organization. Enhance your. An effective supervisor must combine job expertise with HR knowledge, people skills, and motivating personal characteristics. The first step to becoming a good. Shift your mindset. Now is the time to become a more versatile leader. As a manager of others, you need to learn new ways of achieving results, because. No matter how you feel about your colleague becoming your new boss, it's important to buy in early and show that you're a willing partner. Embrace the situation. Going from a colleague to becoming the boss of your former peers is never an easy step to take. We show you how best to navigate that difficult transition. boss to play the role of “enforcer.” The manager still has to be prepared to hold his or her team members accountable should peer support and pressure fail. In an ideal environment, your new manager should communicate to any other candidates that you got the job before the communication is made public. If you have. Learn effective strategies for managing your peers and navigating the transition to a leadership role in Lindsey Pollak's insightful guide. If you work with any type of team, it is important to note that it isn't only you and your boss who have a stake in your performance, your colleagues are. 1. Make it official · 2. Acknowledge the awkwardness · 3. Signal the change · 4. Be confident — but humble · 5. Talk to HR · 1. Your former peers don't acknowledge. Being promoted over your former peers brings unique challenges. Learn how to transition into a leadership role while maintaining your past work. This supervisor workshop by Peter Barron Stark is made to teach your new leaders how to become good supervisors of their former peers. Identify opportunities and challenges in your transition to supervisor · Apply your leadership strengths to personal barriers in your leadership goals · Determine. Who Should Attend · Establish Credibility as a New Supervisor with Your Boss, Peers, and Team Members · Leverage Behavioral Style to Improve Relationships with. The first step in becoming a successful supervisor is understanding the fact that your new role requires you to deal with new challenges. Identify opportunities and challenges in your transition to supervisor · Apply your leadership strengths to personal barriers in your leadership goals · Determine. Figure out what is triggering that behavior and work to correct it. As supervisor/manager/leader, it is your duty to find out what is. Being promoted from within is recognition that you've done well. It's also an extra challenge because you now have to reset relationships with peers and. Tips for successfully transitioning to supervisor · Realize relationships may change · Discuss the change with your team · Ask for feedback · Seek advice from other. There will be challenges there too and you need to be aware of the relationship reshaping that needs to happen. • You have a new boss – don't expect them to.

American Express Credit Card Rules

Applying for an American Express Credit Card is fast and can be done in 3 easy steps. Check your eligibility, choose your Card and apply online today. The best cards typically require the highest credit scores. American Express also has specific rules for the cards it issues. For example, you usually aren't. Amex has a 5 credit card limit, meaning you cannot have more than 5 Amex credit cards open at any one time. Some people are bumping into an issue at 4 cards as. American Express Platinum Card® for Schwab details · Earn 5X Points · $ Hotel Credit, $ Airline Fee Credit · $ Digital Entertainment Credit · $ CLEAR®. Express Corporate Card. The Corporate Card is an American Express (hereafter,. AMEX) credit card designed specifically to facilitate small purchases of. This means the spending limit is flexible. In fact, unlike a traditional credit card with a set limit, the amount you can spend adapts based on factors such as. IMPORTANT: Before you use the enclosed American Express Credit Card, please read these Terms and Conditions carefully and thoroughly. You should have a good credit score and no history of bad credit, such as any earlier loans or outstanding Credit Card balances that you failed to repay on time. More than a decade ago, American Express would allow you to earn welcome offers on the exact same card multiple times. However, since , the issuer has. Applying for an American Express Credit Card is fast and can be done in 3 easy steps. Check your eligibility, choose your Card and apply online today. The best cards typically require the highest credit scores. American Express also has specific rules for the cards it issues. For example, you usually aren't. Amex has a 5 credit card limit, meaning you cannot have more than 5 Amex credit cards open at any one time. Some people are bumping into an issue at 4 cards as. American Express Platinum Card® for Schwab details · Earn 5X Points · $ Hotel Credit, $ Airline Fee Credit · $ Digital Entertainment Credit · $ CLEAR®. Express Corporate Card. The Corporate Card is an American Express (hereafter,. AMEX) credit card designed specifically to facilitate small purchases of. This means the spending limit is flexible. In fact, unlike a traditional credit card with a set limit, the amount you can spend adapts based on factors such as. IMPORTANT: Before you use the enclosed American Express Credit Card, please read these Terms and Conditions carefully and thoroughly. You should have a good credit score and no history of bad credit, such as any earlier loans or outstanding Credit Card balances that you failed to repay on time. More than a decade ago, American Express would allow you to earn welcome offers on the exact same card multiple times. However, since , the issuer has.

Edit: one more AMEX quirk - AMEX allows 5 credit cards (occasionally someone may be approved for a 6th but 5 is the general rule) and up to Your privileges begin the moment you activate your Amex Card. From exclusive offers, to iconic events, all designed with your needs in mind. Every time you. If you have POT enabled on your charge card, AmEx lets you make monthly payments as though it were a credit card. American Express also offers. There's only one credit card that takes you places with your preferred airline: Delta SkyMiles Credit Cards from American Express. American Express Application Rules · Rule 1: 18 years old and a U.S. Citizen or Legal Resident · Rule 2: Ideally + Credit Score · Rule 3: Once-In-A-. after you spend $3, in eligible purchases on your American Express Green Card® within the first 6 months of Card Membership.†. What's more, you'll enjoy a great value monthly interest rate of just %. Retail Protection. Items bought with your Card are insured for up to 90 days. There's only one card that takes you places with your preferred airline, the Delta SkyMiles Personal Credit Card from American Express. Terms apply to American Express benefits and offers. Visit bitcoin-money.site to learn more. Premium luxury credit cards, or "black cards," are the most. Find American Express Credit Card Terms for Purchase Protection for Eligible Credit Cards. Learn More About this Benefit & Purchase Protection Policies. American Express Card Member signatures are now optional on any Card-present transaction. Get the FAQs. There are no published rules regarding how often you can get a new Amex credit card. But based on data points, you can only get one credit card per five-day. The “1 in 5” Rule This is the one card rule in every 5 days, meaning you can't be approved for more than 1 card every 5 days with Amex. This appears to apply. If you're planning on going with the charge cards Given their new rule you'd have to go Gold then Platinum, assuming you'd want the sign up. You're limited to 1 approved credit card every 5-day rolling period and 2 approved credit cards every 90 day rolling period. This rule only applies to credit. A surcharge is a fee that merchants may assess on credit card transactions to help offset the cost of Discover and American Express do not require. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. Last month, the U.S. Supreme Court sided with American Express (Amex) on upholding a provision in its contract that prohibits merchants from persuading. in compliance with all local laws and regulations (including those the current Standard Credit Card Charge form approved by the Air Traffic.

Short Strategy

An equity long-short strategy is an investing strategy, used primarily by hedge funds, that involves taking long positions in stocks that are expected to. A short call is a single-leg, bearish options strategy with undefined risk and limited profit potential. Short calls are profitable if the underlying asset's. Short-term strategies such as day trading and scalping are particularly effective for capturing small but repetitive gains throughout the day, if successful. Short Put or Selling Put is recommended when the price of the underlying asset is expected to rise & the stock is not expected to fall further and remain. What is the best strategy? Directional puts have not worked well for me due to the vol crush plus the trade often takes weeks or even months to play out. A Long-Short strategy will rank all stocks in a basket to identify which stocks are relatively cheap and expensive. Long-short strategies are designed to have lower sensitivity to equity market movements, as measured by beta, volatility and drawdowns. Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and. Knowing the short-interest can lead to a strategy that consists of simply joining informed short-sellers. The long-short variation (our screener also. An equity long-short strategy is an investing strategy, used primarily by hedge funds, that involves taking long positions in stocks that are expected to. A short call is a single-leg, bearish options strategy with undefined risk and limited profit potential. Short calls are profitable if the underlying asset's. Short-term strategies such as day trading and scalping are particularly effective for capturing small but repetitive gains throughout the day, if successful. Short Put or Selling Put is recommended when the price of the underlying asset is expected to rise & the stock is not expected to fall further and remain. What is the best strategy? Directional puts have not worked well for me due to the vol crush plus the trade often takes weeks or even months to play out. A Long-Short strategy will rank all stocks in a basket to identify which stocks are relatively cheap and expensive. Long-short strategies are designed to have lower sensitivity to equity market movements, as measured by beta, volatility and drawdowns. Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and. Knowing the short-interest can lead to a strategy that consists of simply joining informed short-sellers. The long-short variation (our screener also.

Long-Short Credit strategies which generally, seek exposure to credit-sensitive securities, long and/or short, mostly based upon the credit analysis of issuers. Intraday Short Selling Strategies Introduction. Intraday short-selling strategies allow you to make money on bearish moves. You typically want to open and close. A short put option is a strategy where an investor sells a put option contract with the expectation that the underlying stock's price will either remain stable. Maximum profit · Maximum risk · Breakeven stock price at expiration · Profit/Loss diagram and table: short strangle · Appropriate market forecast · Strategy. Short selling is when you sell an asset you don't own in the hope of buying it back later at a lower price to capture the difference as profits. A short call is an option strategy where an investor writes (sells) a call option on a stock because he expects that stock's price to decrease. Short Restricted Strategy Call (SL Call). A Short Restricted Strategy call (SL) generates when a cash or IRA account ends up with a short stock position. A. The long-short equity strategy refers to portfolios with a mixture of long and short positions to capitalize and profit from both rises and declines in market. A short put strategy involves selling put options to generate income, with the primary risk being the potential obligation to buy the stock at a higher-than-. Long/short equity positions refer to investments in the stock market where you feel shares are either over- or under-valued. Shorting a stock is technically selling a stock you don't own for a current price with the obligation to buy it back at whatever the market price is at a later. The number one rule when short selling stocks is to always use a stop loss order. A simple stop-loss order gives total protection. A short put is a single-leg, bullish options strategy with undefined risk and limited profit potential. Short puts are profitable if the underlying asset's. The short call option is an excellent strategy for experienced investors who want to capitalize on selling volatility when markets are overbought. As time moves. Maximum profit · Maximum risk · Breakeven stock price at expiration · Profit/Loss diagram and table: short straddle · Appropriate market forecast · Strategy. A long/short investment strategy involves hedge funds, and the knowledge of which stocks are expected to rise and fall. Find out more with BlackRock. The short put is a bullish options trading strategy, so you would use it when you expect a security to go up in value. Because you can only make a fixed amount. The Phineus Long/Short Strategy has an absolute return investment mandate that seeks to achieve the most opportunistic, risk-adjusted return with the. The FTSE ® Daily Super Short Strategy Index (the "Index") is a leveraged inverse index. The daily percentage change in the level of the Index is intended to. A short straddle is a seasoned option strategy where you buy a call and a put at the same strike price, allowing for profit if the stock remains at or.